📊 Daily Market Intelligence Report

Monday, March 09, 2026

7:00 AM CST

📊 Top-Line Summary

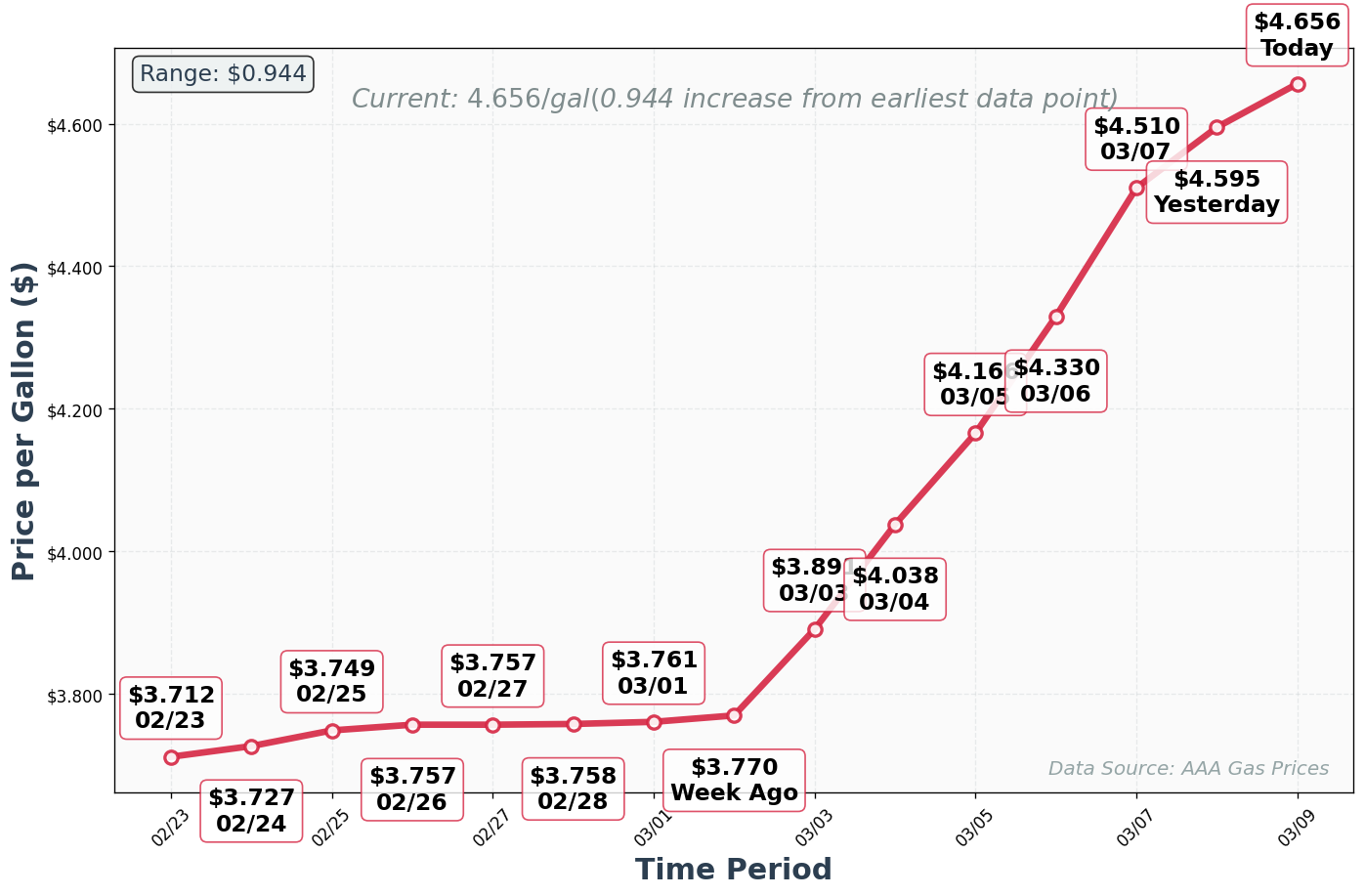

The spot market is experiencing a compounding capacity and cost shock as the national average diesel price climbs further to $4.656/gallon, driven by escalating global tensions and the closure of the Strait of Hormuz. This fuel crisis is colliding with a 9.5% day-over-day rebound in total available loads, now sitting at 157,305, pushing the market average rate to $2.36/mile. The West Coast continues to grapple with the structural fallout of 13,000 canceled commercial driver's licenses, while the Southeast sees tightening capacity due to early produce staging and port urgency. With flatbed dominating the board at over 67,000 loads and reefer paid rates surging to $2.63/mile, brokers must prioritize immediate capacity procurement and aggressive fuel surcharge negotiations to protect margins in a rapidly inflating rate environment.

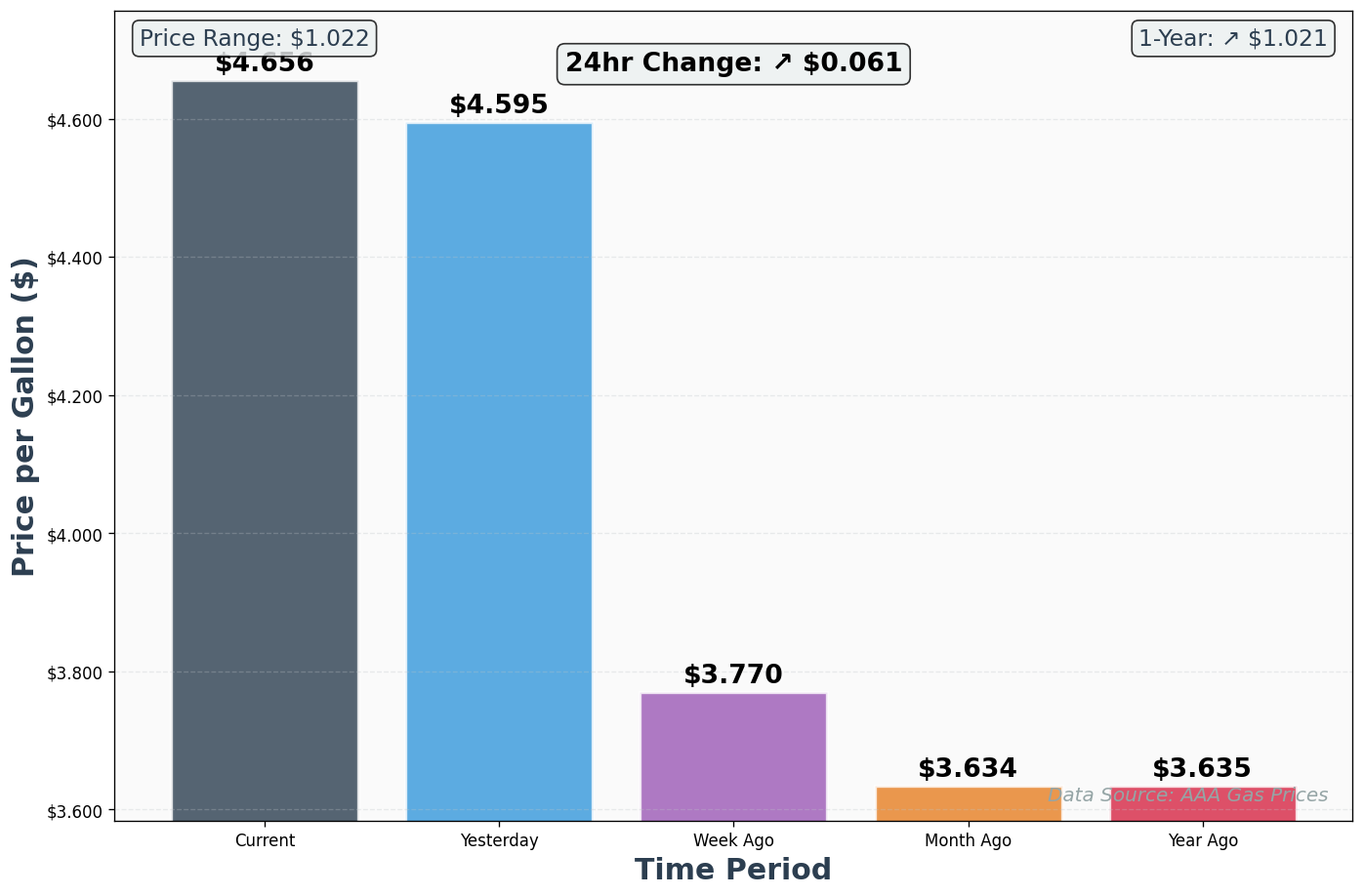

⛽ Diesel Price Analysis

AAA Historical Price Comparison

🌦️ Weather & Seasonal Intelligence

Current Major Weather Events:

- Spring Thaw and Seasonal Transition (National / Northern Tier): No significant severe weather alerts are currently active. However, seasonal spring thaw conditions in the Northern tier are initiating localized weight restrictions on secondary roads, requiring careful routing for heavy haul and flatbed freight.

⛈️ Weather Impact Cascade

- Immediate Operational Impact: Spring thaw conditions currently active across the Northern tier — spanning Minnesota, Wisconsin, Michigan, and the Dakotas — are triggering seasonal weight restrictions on secondary and rural roads that directly limit payload capacity for flatbed and heavy haul equipment operating in agricultural and construction staging corridors. Carriers running steel, lumber, and aggregate into these markets are forced to either reduce payload to comply with posted limits, which erodes revenue per load, or reroute entirely onto interstate corridors that add mileage and fuel cost to already margin-compressed operations. The practical effect today is that effective flatbed capacity in the Northern tier is running at approximately 75-80% of its nominal availability, as payload restrictions function as a de facto capacity reduction even when trucks are physically present in the market. Brokers covering construction and industrial freight into Minnesota, Wisconsin, and Michigan should communicate weight restriction impacts to customers immediately and build routing contingencies that account for 10-15% longer transit times on secondary road portions.

- Secondary Market Effects: The weight restriction environment in the Northern tier is generating downstream pressure on Midwest and Central Plains flatbed markets as carriers that would normally flow northward instead saturate Chicago, Indianapolis, and Kansas City load boards, creating temporary pockets of localized capacity surplus in those hubs while Northern destination markets remain underserved. This displacement effect will elevate rates on direct Northern tier lanes while paradoxically suppressing rates slightly on Chicago-area crosstown and short-haul moves as carrier density builds up in that hub through mid-week. Secondary reefer markets in the Upper Midwest — particularly dairy and frozen food freight out of Wisconsin and Minnesota — will face compounded challenges from weight restrictions limiting pickup access to farm-level facilities, creating delivery delays that cascade into inventory management issues for major food manufacturers. As thaw conditions progress through the week, the daily fluctuation in weight restriction enforcement creates unpredictable day-to-day capacity availability, making it difficult for brokers to quote reliable transit times without real-time road condition monitoring.

- Regional Spillover Analysis: Northern tier weight restrictions are redirecting freight flows that would normally use secondary highways onto I-90, I-94, and I-80 corridors, increasing competitive pressure on those transcontinental arteries and effectively tightening capacity in Chicago and Twin Cities metropolitan areas as carriers cluster on approved routes. This concentration effect on major interstates increases the probability of driver hours-of-service conflicts and relay point bottlenecks at truck stops along those corridors, which will begin manifesting as pickup and delivery appointment misses by Tuesday and Wednesday of this week. The Southeast and Gulf Coast markets remain largely insulated from Northern tier weather effects in terms of direct operational disruption, but will indirectly benefit from reduced flatbed competition as Northern-bound loads stall, keeping more equipment available and competitive for Southern construction and energy freight. Midwest distribution centers servicing retail replenishment chains into the Northern tier should be advised to front-load their weekly shipping schedules toward Monday and Tuesday before weight restriction enforcement peaks mid-week.

- Recovery Timeline: Current spring thaw weight restrictions in the Northern tier typically follow a predictable diurnal cycle — restrictions are most severe during daytime hours when ground temperatures rise above freezing, with overnight freezing temporarily restoring full payload allowances for pre-dawn departures. Full seasonal restriction lifts in Minnesota and Wisconsin historically occur between late March and mid-April depending on temperature trajectory, suggesting operations will not fully normalize on secondary roads until approximately the week of March 23-27 under current seasonal progression forecasts. In the near term, the period from Thursday March 12 through Sunday March 15 represents the most operationally constrained window as mid-week temperature peaks coincide with the highest construction and agricultural freight volumes of the week. Brokers should communicate to Northern tier customers that full normal capacity availability and standard transit times cannot be reliably guaranteed until after March 27, and should build service agreements accordingly.

💰 Financial Market Indicators

- Diesel Futures: Global crude benchmarks have crossed $110/barrel following the closure of the Strait of Hormuz, signaling that domestic diesel prices will remain elevated and volatile for the foreseeable future.

- Carrier Financial Health: Small to mid-sized carriers are facing an existential cash flow crisis as the lag between fuel purchases at $4.656/gal and invoice payments threatens to bankrupt operators without strong capital reserves.

- Economic Indicators: Industrial production and energy sector staging are accelerating rapidly as domestic producers attempt to offset global supply chain disruptions caused by Middle East conflicts.

📰 Impactful News Analysis

-

Global Oil Crisis Threatens Domestic Supply Chains as Hormuz Closes 🔗:

The closure of the Strait of Hormuz has sent global crude prices soaring, directly impacting domestic diesel costs which have now hit $4.656/gal. Brokers must immediately adjust pricing models to account for volatile fuel surcharges and prepare for carriers to reject long-haul freight that doesn't offer substantial fuel compensation. This geopolitical event will likely sustain the current rate inflation cycle.

-

Ocean Carriers Implement Emergency Surcharges Amid Global Congestion 🔗:

With major ocean carriers like CMA CGM implementing new port congestion surcharges and rate hikes, shippers are facing increased international logistics costs. For domestic freight brokers, this means shippers will likely lean heavily on expedited spot market drayage and transloading services to recover delayed freight at East and Gulf Coast ports, creating high-margin opportunities in coastal markets.

-

Aging Fleets and Cost Increases Loom as Equipment Orders Shift 🔗:

Preliminary Class 5-8 net orders indicate growing confidence in sticky freight rates, but upcoming EPA'27 cost increases are forcing carriers to hold onto aging equipment longer. Brokers should anticipate higher breakdown rates and maintenance-related service failures, making strict carrier vetting and robust track-and-trace protocols essential for protecting high-value customer freight.

News Impact Timeline

- Immediate Operational Reality: The Strait of Hormuz closure is producing real-time operational impacts today in the form of carrier fuel surcharge renegotiation demands, with many owner-operators and small fleet carriers refusing to move under existing contracted FSC tables that were calculated at $3.50-$4.00 per gallon diesel benchmarks, rendering those agreements economically nonviable at today's $4.656 per gallon price. Ocean carrier emergency surcharges implemented by lines including CMA CGM are landing on shipper invoices this week for shipments already in transit, creating an immediate cash flow shock that is accelerating the shift of import freight to spot market domestic trucking as shippers look to reduce further international logistics exposure. The CDL cancellation fallout on the West Coast is not a future risk — it is an active operational constraint today, with carriers reporting difficulty assembling compliant driver teams for multi-day Western hauls and terminal operators noting measurable slowdowns in dray cycle times at Los Angeles and Long Beach. Brokers who have not yet communicated rate adjustment needs to their contracted shipper customers are already operating at margin risk on any loads tendered today under pre-crisis pricing.

- 3-Day Market Implications: Over the next 72 hours through Thursday March 12, the spot market will absorb the first full wave of routing guide failures as contracted carriers reject tendered loads at scale, pushing unprecedented volumes of freight into the spot market and driving the national average rate materially above today's $2.36 per mile benchmark. The ocean carrier surcharge cascade will accelerate shipper decision-making around port diversification, with Tuesday and Wednesday likely to see a surge in drayage and transload booking requests out of Savannah, Houston, and Jacksonville as shippers scramble to move cargo that has been sitting on vessels or at port facilities. Fuel prices are expected to remain at or above current levels through at least Thursday based on crude futures positioning above $110 per barrel, meaning carrier rate demands will not moderate and brokers must price all new commitments with forward-looking fuel cost assumptions rather than today's spot diesel price. By Wednesday March 11, the broker community will have a clearer picture of which contracted carrier relationships have survived the fuel shock and which have effectively collapsed, allowing for more targeted capacity procurement strategies in the back half of the week.

- Week-Ahead Positioning: The strategic window for locking in carrier capacity at the most favorable rates available in this crisis environment is Monday and Tuesday of this week, before the full scope of routing guide failures becomes apparent and carriers gain additional negotiating leverage from the visibility of shipper desperation. Brokers should use this narrow window to commit capacity on their highest-volume, highest-margin lanes — particularly the Southeast produce and port corridors — even if it requires paying above current market posted rates to secure carrier commitments through Friday. By Thursday and Friday, the market will likely have repriced to a new equilibrium that is 8-15% higher than today's averages as the compounding effects of fuel costs, CDL shortages, and port disruptions fully materialize in the spot rate data. Brokers who have secured capacity commitments earlier in the week will be able to honor customer freight and protect relationships, while competitors scrambling for last-minute capacity on Thursday and Friday will face both higher costs and reduced carrier reliability.

- Regulatory Compliance Impacts: The 13,000 CDL cancellations on the West Coast represent a permanent regulatory compliance action, not a temporary suspension, meaning the affected driver pool cannot be quickly reinstated and carriers must immediately restructure their driver assignments, hours-of-service planning, and route coverage for Western lanes. Brokers placing freight with West Coast carriers must now include carrier compliance verification as a standard pre-booking step, confirming that the assigned driver holds a valid, non-revoked CDL before committing a load — a step that was previously routine but has become critical given the scale of the regulatory action. The EPA 2027 engine emissions standards are creating a secondary compliance pressure as carriers holding older equipment must decide between costly upgrades and fleet reduction, with many small carriers choosing to reduce their active truck counts rather than invest in pre-revenue compliance spending during a period of margin compression from fuel costs. Brokers should update their carrier onboarding and re-verification protocols this week to include explicit CDL status confirmation for all West Coast operators and should flag any carrier with a high concentration of older pre-emissions-compliant equipment as an elevated service failure risk.

🔍 Competitive Intelligence

- Digital Load Board Trends: Spot volume has rebounded 9.5% overnight to 157,305 loads, with the market average rate pushing to $2.36/mile. The spread between posted and paid rates is narrowing as brokers are forced to meet carrier demands instantly to secure capacity.

- Capacity Alerts: The West Coast remains critically tight due to the ongoing 13,000 CDL cancellation fallout, while the Southeast is seeing rapid capacity absorption from early produce staging and port recovery efforts.

- Technology Disruptions: The rapid escalation of fuel costs is driving accelerated adoption of dynamic pricing APIs and automated fuel surcharge calculators as brokerages attempt to protect margins in real-time against intraday fuel price swings.

Demand Shift Indicators

- Regional Demand Predictions: Demand will continue migrating away from the West Coast over the next 5-7 days as the structural impact of 13,000 CDL cancellations suppresses carrier availability and inflates transit times beyond shipper tolerance thresholds. Southeast and Gulf Coast freight corridors are absorbing the displaced volume, particularly in van and reefer segments where shippers are rerouting imports through alternative port gateways including Savannah, Jacksonville, and Houston. Mid-Atlantic distribution hubs will see secondary demand surges as retailers attempt to replenish spring inventory through East Coast ports rather than risk continued West Coast delays. Expect national load board volumes to sustain above 150,000 loads through at minimum mid-week as this demand redistribution plays out across the spot market.

- Seasonal Transition Analysis: March historically marks the inflection point for produce season in the Southeast, where Florida citrus transitions to Southeastern vegetable staging across Georgia, South Carolina, and the Carolinas — a pattern that is currently running approximately 2-3 weeks ahead of normal seasonal pace due to favorable growing conditions and elevated shipper urgency to pre-position inventory ahead of anticipated supply chain disruptions. The spring construction season is simultaneously pulling flatbed equipment northward into the Great Plains and Midwest, creating competing equipment demands that will stress specialized carrier networks through at least late March. The confluence of these two seasonal demand waves arriving simultaneously — produce season and construction staging — is amplifying the already fuel-cost-driven rate environment to levels not typically seen until late April. Brokers who historically rely on seasonal playbooks from prior years will find their rate models 15-25% below current market realities if not recalibrated immediately.

- Economic Leading Indicators: The crossing of crude oil benchmarks above $110 per barrel functions as a hard economic pressure signal that typically precedes a 2-3 week lag in full domestic diesel price transmission, meaning the current $4.656 per gallon figure may not yet reflect the ceiling of this pricing cycle. Industrial production acceleration, as domestic manufacturers rush to buffer inventory against global supply chain disruptions from the Hormuz closure, is generating sustained flatbed demand that mirrors the demand profiles seen during post-COVID restocking surges in 2021. The narrowing spread between posted and paid rates — currently van at $0.04 gap, reefer at $0.10 gap — is a leading indicator that the spot market is transitioning from a negotiated environment to a take-it-or-leave-it carrier's market, which historically precedes a sharp upward rate correction within 5-7 business days. Consumer demand for spring goods remains robust, providing a demand floor that prevents any meaningful softening in load volumes even if fuel prices create temporary carrier capacity withdrawal.

- Capacity Flow Predictions: Equipment will continue flowing from the West Coast toward the Southeast and Gulf Coast as carriers seek to maximize revenue per mile by repositioning into higher-yield markets with stronger outbound freight density. Reefer equipment will be particularly aggressively repositioned toward Florida and Georgia produce corridors over the next 48-72 hours, temporarily creating pockets of van capacity surplus in inland California markets before those units are absorbed by alternative industrial freight. Flatbed equipment is expected to begin migrating northward into construction staging zones across the Ohio Valley and Great Lakes corridor by mid-week, pulling specialized capacity away from Southern energy sector freight and creating rate pressure in Texas and Louisiana heavy haul markets. Owner-operators — who represent a disproportionate share of the reefer and flatbed capacity pool — will self-select into the highest-yielding lanes, making capacity in secondary markets and shorter-haul corridors increasingly unreliable for shippers without strong carrier relationships.

👥 Customer Sector Analysis

- Retail: Retailers are scrambling to secure inbound capacity from ports as ocean freight disruptions threaten spring inventory positioning, leading to increased willingness to pay spot premiums.

- Manufacturing: Industrial output is driving massive flatbed demand (67k+ loads) as domestic manufacturing attempts to buffer against global supply chain shocks.

- Agriculture: Early produce staging in the Southeast and California is absorbing specialized reefer capacity, driving paid rates up to $2.63/mile and leaving standard food/beverage shippers competing for scarce equipment.

- Automotive: Just-in-time automotive supply chains are facing severe risks from the combination of West Coast driver shortages and Midwest routing disruptions, increasing demand for expedited team transit.

🗺️ Regional & Lane Analysis

📍 Primary Region Focus: Southeast US

The Southeast is currently the most dynamic and profitable region for freight brokers, driven by a convergence of early produce season staging, urgent port recovery efforts, and severe fuel-driven rate volatility. With diesel at $4.656/gal, carriers are demanding massive premiums to enter dead-end markets like Florida, while simultaneously capitalizing on urgent outbound agricultural freight. The region is seeing rapid capacity absorption, particularly in the reefer sector where paid rates are hitting $2.63/mile nationally. Port markets like Savannah and Jacksonville are experiencing acute tightness as shippers rush to transload cargo ahead of escalating ocean carrier surcharges.

🛣️ Key Lane Watch

Atlanta, GA → Miami, FL:

This lane is experiencing extreme rate pressure as carriers demand heavy premiums to cover the $4.656/gal diesel costs for the long transit into a historically weak outbound market. Capacity is actively avoiding South Florida unless compensated for the deadhead out, pushing van and reefer rates significantly above historical averages. Demand remains strong for retail and consumer goods moving into the dense population center.

Savannah, GA → Charlotte, NC:

Port congestion and new ocean carrier surcharges are driving urgent transload and drayage demand out of Savannah. Shippers are bypassing traditional rail networks in favor of immediate spot truckload capacity to get freight into inland distribution centers like Charlotte. The 9.5% national increase in load volume is heavily reflected in this corridor.

🚨 Actionable Alerts

Rate Spike Warnings:

- All inbound Florida lanes (fuel/deadhead premiums)

- West Coast outbound lanes (CDL shortage impact)

- Heavy haul and specialized flatbed nationally ($2.67/mile average)

Capacity Shortage Alerts:

- Severe shortages of reefer equipment in the Southeast due to produce staging, and a structural shortage of van capacity on the West Coast due to regulatory CDL cancellations.

Opportunity Zones:

- Outbound Florida (bundling with inbound freight)

- Savannah/Charleston port transload corridors

- Short-haul Midwest lanes avoiding flood zones

🎯 Strategic Recommendations for Today

💼 For Customer Sales:

Narrative: Global oil market disruptions and the closure of the Strait of Hormuz have pushed diesel to $4.656/gal, fundamentally altering carrier operating costs. Combined with the West Coast driver shortage, we are entering a period of structural capacity tightness requiring immediate adjustments to routing guides.

Action: Proactively contact all contracted customers today to renegotiate fuel surcharge tables or transition vulnerable lanes to dynamic spot pricing before service failures occur.

🚛 For Carrier Reps:

Sourcing Focus: Focus heavily on securing specialized flatbed and reefer capacity, as these equipment types are seeing the highest demand and fastest rate growth. Prioritize regional fleets in the Southeast.

Negotiation Leverage: Use the promise of guaranteed backhauls (especially out of dead-end markets like Florida) as your primary leverage to secure inbound capacity at reasonable rates despite the fuel crisis.

🔑 Executive Signal Summary

This is a fast repricing market, not a clean freight boom: Total available loads are 157,305, up 9.5% from 143,597, but the more important signal is that the national average rate jumped to $2.36/mile while diesel sits at $4.656/gallon. That combination usually means replacement cost is rising faster than many shippers realize.

Open-deck is still where the day is won or lost: Flatbed (67,421) + Heavy Haul (35,688) + Specialized (15,756) = 118,865 loads, or about 75.6% of the board. If your floor is staffed like a dry van day, you are pointed at the wrong market center of gravity.

Carrier leverage is strongest in reefer and building in van:

- Reefer: $2.53 posted / $2.63 paid

- Van: $2.16 posted / $2.20 paid

When paid is above posted, the board is lagging real buying conditions.

Flatbed is already repriced: Posted and paid are both $2.59/mile. That tells me the market has already accepted the higher cost basis. You will not make your money here by squeezing carriers; you will make it through load detail control, accessorial discipline, and dependable execution.

LTL (Less Than Truckload) / Partial is the outlier: $1.63 posted / $1.56 paid. This is the only segment showing visible softness beneath the posting, which makes it useful for disciplined consolidators, but dangerous for brokers trying to improvise service-sensitive freight.

Best read of the day: The biggest risk is not paying up for good capacity. It is selling freight too cheaply in lanes that will reprice before pickup.

📊 What the board is really saying

Volume is up, but capacity quality is tighter than the headline suggests:

- Current total loads: 157,305

- Yesterday: 143,597

- One week ago: 167,676

Even though current volume is below one week ago, the average rate is now $2.36/mile versus $2.25/mile one week ago. That is a classic sign that capacity conditions have worsened faster than raw volume would imply.

Today’s rate move matters:

- Average rate yesterday: $2.27/mile

- Average rate today: $2.36/mile

A $0.09/mile move in one day is meaningful. That is not noise. That is the market telling you carrier replacement cost and urgency have changed.

The money on the board is expanding:

- Market opportunity today: $201.3M

- Yesterday: $183.0M

More dollars are chasing freight, but not all of that becomes broker margin. In volatile fuel markets, higher gross revenue can hide weaker net margin if your pricing logic is stale.

The market is becoming less negotiable in the segments that matter most operationally:

- Reefer paid above posted by $0.10

- Van paid above posted by $0.04

- Heavy Haul paid above posted by $0.01

- Specialized paid above posted by $0.03

That tells me the market is shifting from “let’s negotiate” to “if you need it, buy it now.”

🚚 Equipment-by-equipment broker read

| Equipment |

Loads |

Posted |

Paid |

What it means |

| Van |

22,359 |

$2.16 |

$2.20 |

Tightening. Reprice long-haul and fuel-sensitive freight now. |

| Reefer |

7,526 |

$2.53 |

$2.63 |

Strongest carrier leverage. Buy capacity early, especially Southeast. |

| Flatbed |

67,421 |

$2.59 |

$2.59 |

Already repriced. Margin comes from execution, not rate negotiation. |

| Heavy Haul |

35,688 |

$2.66 |

$2.67 |

Operational market. Permit, route, and site readiness matter more than pennies. |

| Specialized |

15,756 |

$2.52 |

$2.55 |

Good opportunity only if dimensions and routing are clean. |

| LTL / Partial |

8,555 |

$1.63 |

$1.56 |

Selective softness. Useful for known networks, risky for one-off freight. |

The practical interpretation

🗺️ Regional plays that matter most today

Southeast: highest-value region on the board

- Why it matters: early produce staging, port urgency, and fuel-driven roundtrip risk are all hitting at once.

- What to do:

- Pre-book reefer and van 48-72 hours out on Florida, Georgia, and Carolinas freight.

- Sell dynamic pricing instead of static routing-guide expectations.

- Pair Florida inbound with outbound reload planning before you quote. Do not buy inbound Florida as a one-leg move unless margin is exceptional.

West Coast: compliance-filtered capacity

- Why it matters: the reported 13,000 CDL cancellations make this a structural legal-capacity problem, not a routine market tightness issue.

- What to do:

- Verify CDL (Commercial Driver’s License) status before dispatch on Western freight.

- Source backup capacity from Arizona, Nevada, Oregon, Washington, and Texas networks where possible.

- Shorten quote validity windows because the truck that was available an hour ago may no longer be real capacity.

Northern tier / Upper Midwest: “available” is not the same as “usable”

- Why it matters: spring thaw weight restrictions are reducing effective payload and adding route miles.

- What to do:

- Quote flatbed and heavy freight with payload and route contingencies.

- Warn customers now that rural access in Minnesota, Wisconsin, Michigan, and the Dakotas may force longer transit or lighter payloads.

- Do not sell normal transit assumptions into restricted secondary-road freight.

Midwest hub pockets: tactical buy opportunities

- Why it matters: some equipment displaced from Northern routes can temporarily crowd hubs like Chicago, Indianapolis, and Kansas City.

- What to do:

- Use those markets for short-haul or crosstown pickups where excess local truck density can help your buy side.

- Do not assume that softness extends northbound into weight-restricted destination freight.

🎯 Lane-level broker strategy

🧠 The psychology driving today’s negotiations

Shippers are anchored to older cost logic:

Many customers still think in last week’s linehaul terms. They have not fully internalized what $4.656/gallon diesel does to carrier behavior on long-haul, dead-end, and temperature-controlled freight.

Carriers are pricing forward, not backward:

Good carriers are not asking, “What did this load pay yesterday?” They are asking, “What does it cost me to survive the next several days if fuel stays elevated?”

Inexperienced brokers will misuse posted rates today:

Posted rates are useful as a signal, but when paid exceeds posted, the real market is moving faster than the screen. If your rep quotes off posted alone, they are likely selling future service failures.

Customers will pay for certainty before they pay for speed:

The strongest sales posture today is:

- We understand the lane change

- We have real, vetted capacity

- We are separating linehaul from fuel logic

- We can give you an honest service plan

That message beats “we can probably cover it” every time in a market like this.

💼 What to say to customers today

For contracted customers on vulnerable lanes:

- Message: “Fuel and replacement-cost conditions have changed. We need to update fuel surcharge assumptions or move specific lanes to dynamic pricing so service does not break later in the week.”

For Florida and Southeast freight:

- Message: “Inbound pricing now depends on outbound recovery. If you want stable coverage, we need either earlier tendering or realistic roundtrip economics.”

For West Coast customers:

- Message: “Capacity is available only if it is legal, verified, and committed early. Same-day recovery assumptions are no longer safe.”

For flatbed and industrial accounts:

- Message: “The truck is only part of the price. Tarping, securement, payload restrictions, route constraints, and site readiness now decide whether the shipment stays profitable and on time.”

A useful closing line:

- “Today’s cheapest quote is often tomorrow’s uncovered load. We are pricing for real capacity, real fuel, and real transit conditions.”

🤝 Carrier desk priorities for the next few hours

Call reefer and flatbed cores before posting

- Reefer is already showing $0.10/mile paid over posted.

- Flatbed is too active to rely on passive board shopping.

- First calls should go to repeat carriers with proven weekend/Monday reliability.

Buy tomorrow and the next day, not just today

- In a rising-cost market, early commitment is usually cheaper than emergency recovery.

- This is especially true for Southeast reefer, Florida inbound, and specialized/open-deck freight.

Use backhaul economics as leverage

- For unattractive destinations, especially South Florida, the cleanest negotiation tool is credible reload planning.

- If you cannot help with the reload, be prepared to pay for the uncertainty.

Tighten compliance verification

- On Western freight, verify CDL status.

- On all critical freight, confirm authority, insurance, and actual driver assignment.

- In a compliance-shocked market, a truck is not real capacity until the details are verified.

Give carriers cleaner information than your competitors

- Commodity

- Exact dimensions

- Weight

- Pickup and delivery hours

- Tarp / securement

- Temperature requirements

- Accessorial expectations

Clean freight details create trust. Trust gets trucks faster than haggling does in a tight market.

⚠️ Margin traps to avoid today

Underpriced long-haul van freight

- Fuel is too high and too unstable to assume yesterday’s buy side still works.

Florida one-way freight without reload planning

- What looks like a decent inbound rate often collapses once the carrier prices the exit.

Reefer freight with vague temperature instructions

- Set-point, continuous run, washout, and receiver requirements must be nailed down up front.

Northern-tier flatbed quoted on nominal payload

- If road restrictions reduce legal payload, your margin can disappear even when the truck shows up.

Port and transload freight with loose appointment handling

- Storage, congestion, free-time loss, and missed windows can turn a “premium” shipment into a headache quickly.

Specialized freight with soft dimensions

- If the load data is wrong, the rate is wrong. On specialized freight, bad information is usually more expensive than bad buying.

📈 24-72 hour probability view

✅ Highest-value actions before midday

Reprice every long-haul, fuel-sensitive, and dead-end-market load

- Separate linehaul from fuel surcharge (FSC).

- Use short quote validity windows.

Shift labor toward open-deck immediately

- 118,865 open-deck-related loads means that is where more of the day’s revenue will be decided.

Pre-book Southeast reefer and Florida freight

- Do not wait for shipper “approval loops” to finish before sourcing.

- Build primary + backup coverage on critical food and produce lanes.

Call contracted customers before they tender failures

- Explain market change in plain English.

- Offer dynamic lane pricing where fixed tables no longer reflect replacement cost.

Treat West Coast capacity as compliance-sensitive freight

- Confirm the truck is legal before you sell the lane.

Exploit LTL/partial selectively

- Only where you control appointments, pallet counts, and service expectations.

- Avoid one-off cheap partials that create claim and rework risk.

Add payload and route language to Northern-tier flatbed quotes

- If the load touches restricted secondary roads, price for that reality up front.

📌 Scoreboard to watch through the day

- Coverage speed: Are your critical loads covering slower than normal?

- Carrier fallout: Are booked trucks trying to reprice after acceptance?

- Fuel leakage: Are your long-haul margins shrinking after carrier callbacks?

- Reefer acceptance: Are Southeast temperature-controlled loads taking extra calls?

- Customer responsiveness: Which accounts accept revised pricing quickly, and which still negotiate off old assumptions?

The desks that win today will not necessarily be the ones with the most loads. They will be the ones that buy the right freight, refuse the wrong freight, and communicate faster than the market reprices against them.

🧭 Bottom line

- The board is bigger today, but the market is harder

- Open-deck still deserves disproportionate attention

- Reefer is the clearest carrier-led segment

- Van is tightening more than casual observers think

- Flatbed margin comes from execution, not rate suppression

- The best brokers today will reprice early, verify harder, and commit capacity before the rest of the market catches up

📅 This Day in History

-141: Liu Che, posthumously known as Emperor Wu of Han, assumes the throne over the Han dynasty of China.

2000: Nupedia, a multi-language online encyclopedia, is launched.

2020: Giuseppe Conte, Prime Minister of Italy, announces in a televised address and signs the decree imposing the first nationwide COVID-19 lockdown in the world.

💭 Quote of the Day

"The secret of perfect health lies in keeping the mind always cheerful - never worried, never hurried, never borne down by any fear, thought or anxiety."

— Sathya Sai Baba