📊 Daily Market Intelligence Report

Monday, November 10, 2025

7:00 AM CST

📊 Top-Line Summary

Spot market volumes rebound to 70,420 loads generating $91.2 million in opportunity, up from yesterday's softer 64,986 loads and $84.3 million as Monday activity revives general freight and industrial flows, with national average rates firming to $2.19 per mile amid selective demand pressures; persistent lake-effect snow across the Great Lakes disrupts I-80 and I-90 corridors with hazardous travel and potential delays, while high winds in Wyoming challenge I-80 transcontinental hauls for high-profile vehicles, and widespread freezes in the Southeast and Texas threaten agricultural shipments on I-10 and I-65 routes, as diesel holds steady at $3.739 per gallon supporting carrier cost stability in a market anticipating holiday-driven capacity shifts.

📈 National Data Dashboard

| Van rates are firming slightly with posted averages at $1.89 per mile and paid rates at $1.90 per mile across 16,185 available loads yielding $21.9 million in opportunity, reflecting a volume uptick from yesterday's levels that signals renewed Monday demand in e-commerce and retail distribution where capacity remains moderately loose nationally due to equipment surpluses in Southern and Western hubs, though driver availability tightens on cross-country routes from qualification backlogs and preferences for regional runs. This rate stability, holding above last week's $1.88 posted figures, connects to seasonal pre-holiday inventory adjustments sustaining load diversity without saturating supply, with urban Northeast corridors showing firmer conditions from congestion versus looser Central surpluses; forward signals from rising volumes indicate potential rate escalation mid-week, allowing brokers to prioritize premium metro deliveries while using backhaul strategies to enhance equipment flow and offset driver repositioning lags for margin gains. |

| Reefer rates demonstrate upward momentum at posted $2.35 per mile and paid $2.37 per mile on 7,340 loads totaling $13.7 million in market value, with volumes expanding from yesterday amid accelerating winter produce protections and holiday food preparations, tying premium pricing—elevated versus week-ago $2.34 averages—to persistent capacity constraints in California and Midwest origins where reefer trailer shortages and specialized driver pools restrict spot flexibility, intensified by freeze threats redirecting units to priority perishables. Seasonal cycles heighten these pressures by boosting cold chain needs over dry van alternatives as temperature sensitivities increase, especially with Great Lakes snow complicating inter-regional transfers; mirroring historical November patterns of rate firmness despite fluctuating volumes, brokers can anticipate sustained premiums into late month, enabling surcharges on urgent commodities while exploring van conversions in surplus areas to bridge availability shortfalls and drive profitability through regional imbalances. |

| Flatbed rates hold steady with posted $2.13 per mile and paid $2.11 per mile across 21,775 loads generating $26.1 million in opportunity, volumes climbing from yesterday to underscore robust construction and energy sector pulls where securement demands intersect with capacity realignments for weekly starts, bolstering pricing against broader softening through equipment scarcities in Texas and Ohio regions. These dynamics stem from limited specialized trailers and driver segments geared toward oversize loads, creating tightness amid high winds diverting general flatbeds; seasonal infrastructure pushes amplify this by favoring flatbed over van for bulky goods as weather challenges mount, particularly along I-80; consistent with historical autumn trends of resilient rates during volume surges, brokers should monitor for upward pressures next week, targeting energy hauls with premium positioning to leverage scarcity while mitigating wind-related delays for operational efficiency and profit optimization. |

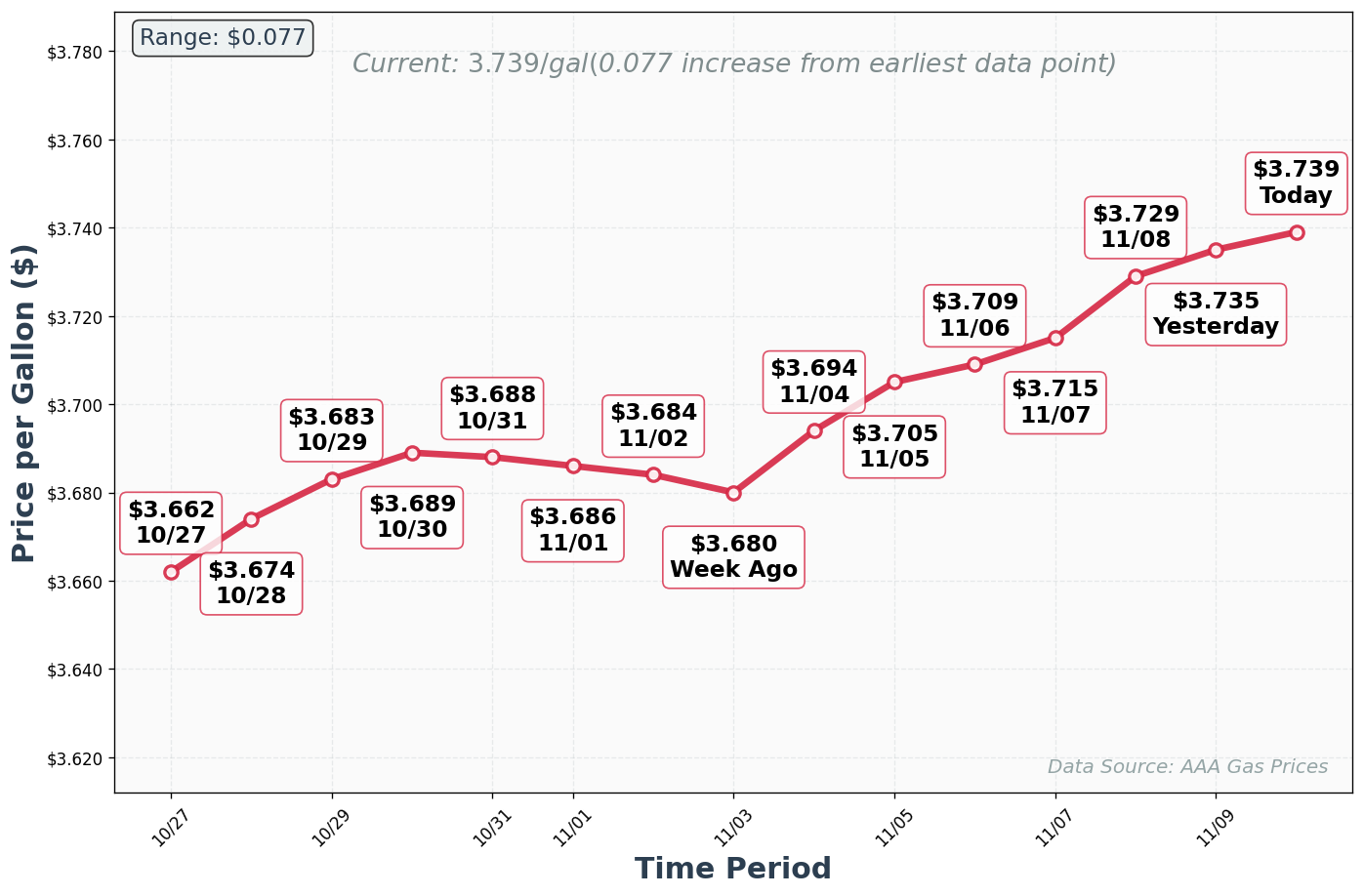

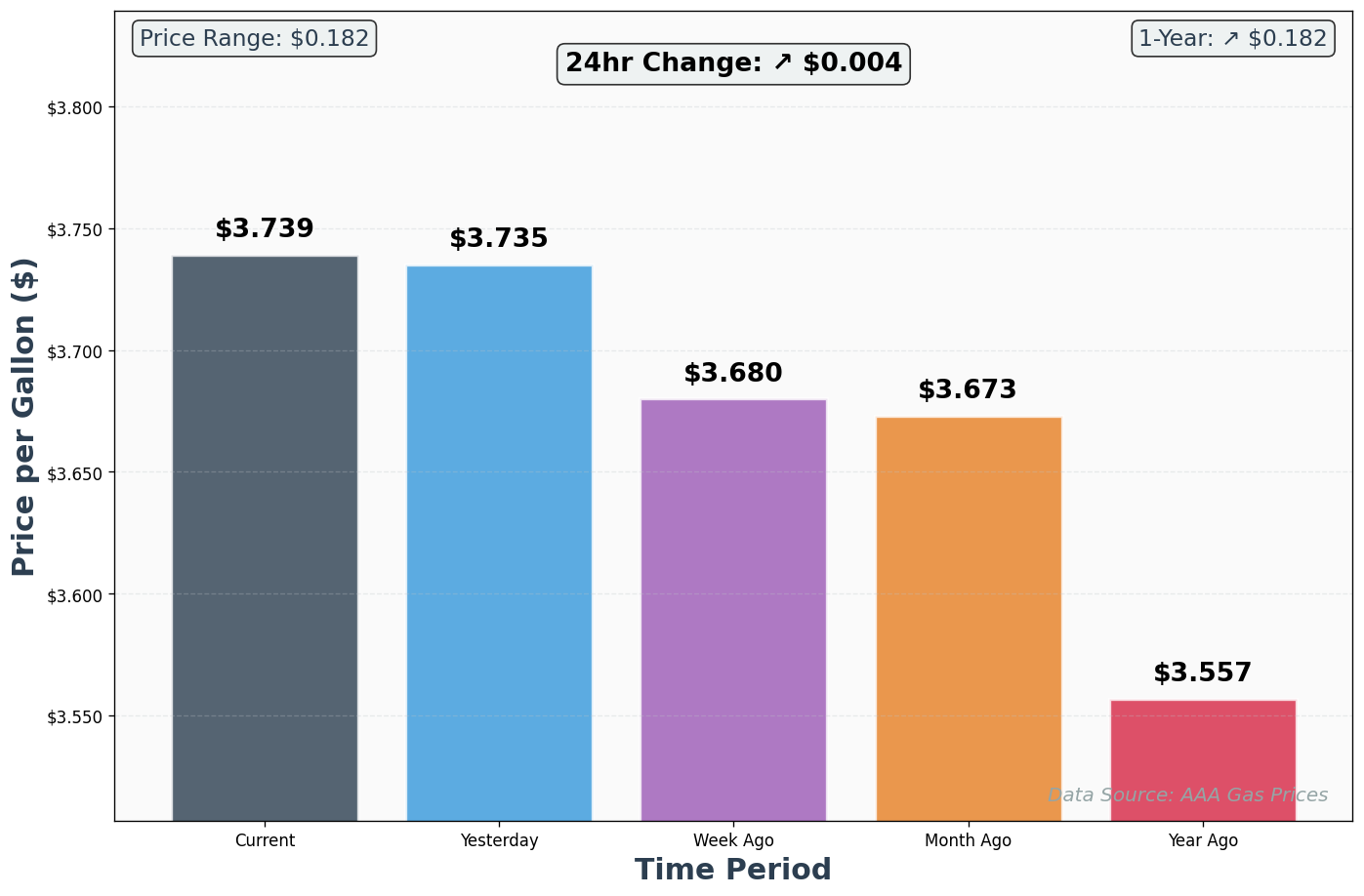

| $3.739/gal - Diesel prices remain stable week-over-week, providing carriers with predictable fuel costs that support margin planning amid rising spot volumes, though regional variations could pressure operations in weather-impacted areas. |

| Tender rejection rates are easing to low levels, indicating ample capacity absorption as volumes rise, which suggests brokers can expect easier carrier matching but should watch for selective rejections in disrupted regions where weather tightens availability. |

⛽ Diesel Price Analysis

AAA Historical Price Comparison

🌦️ Weather & Seasonal Intelligence

Current Major Weather Events:

- Lake-effect winter storm with heavy snow accumulations (Northern Illinois (IL) and Northern Indiana (IN), including areas near I-80 and I-90): Slippery roads and reduced visibility will cause delays on major Midwest freight corridors, potentially stranding loads and forcing reroutes that tighten capacity and elevate spot rates for brokers handling time-sensitive shipments.

- High wind warnings with gusts up to 70 mph (Southern Wyoming (WY), affecting I-80 summit and I-25 near Cheyenne and Laramie): Strong crosswinds pose hazards to high-profile trucks and trailers, leading to slowdowns, closures, and capacity pullbacks on transcontinental routes, creating opportunities for brokers to secure premium hauls via alternative paths.

- Widespread freeze warnings with sub-freezing temperatures (Southeast North Carolina (NC), Northeast South Carolina (SC), and portions of Georgia (GA)): Frost risks could damage crops and delay agricultural loadings, disrupting I-95 and I-20 flows and prompting urgent reefer repositioning, where brokers can capitalize on premium cold chain rates amid reduced carrier willingness.

- Freeze warning with temperatures as low as 25 degrees (North and Central Texas (TX), impacting I-35 and I-20 corridors): Potential crop losses and plumbing issues at facilities may slow industrial and ag shipments, tightening flatbed and reefer capacity on key South Central routes and offering brokers arbitrage from weather-driven demand spikes.

⛈️ Weather Impact Cascade

- Immediate Operational Impact: Lake-effect snow in Northern Illinois and Indiana is causing 2-4 hour delays on I-80 and I-90 today (Monday). Light snow continues through Tuesday with winds 19-28 mph, creating hazardous conditions. Carriers are reducing speed and increasing following distances, which compounds delays. High winds in Wyoming (currently 12-17 mph, forecasted to increase to 20-25 mph by Thursday) are affecting high-profile vehicles on I-80 summit, causing selective closures and reroutes. Freeze warnings in Southeast (current temps 52°F in SC/GA with winds 18-29 mph) are creating urgency for agricultural operations but not yet causing operational disruptions. Texas freeze threat (current temps 22°F, warming to 43°F today) is clearing, reducing immediate agricultural risk.

- Secondary Market Effects: Rerouted freight from I-80/I-90 is flowing via I-70 and I-75, creating temporary capacity tightness on alternative routes. Carriers avoiding Wyoming I-80 routes are repositioning equipment southbound, creating temporary surpluses in Southwest and deficits in Midwest. Agricultural evacuations from Southeast will create reefer demand surge Tuesday-Wednesday, pulling capacity from other regions. Delayed loads from Monday-Tuesday weather will cascade into Wednesday-Thursday, creating secondary demand peaks as shippers accelerate shipments to meet delivery commitments. This cascade effect will amplify rate premiums mid-week before normalizing Friday.

- Regional Spillover Analysis: Midwest weather disruptions are creating spillover effects in Northeast (congestion from rerouted freight) and Southeast (capacity pulls for agricultural evacuations). Wyoming wind issues are affecting transcontinental flatbed capacity, creating surpluses in Southwest and deficits in Southeast/Midwest. Texas freeze threat (now clearing) was creating potential agricultural demand but is resolving without major disruption. The primary spillover effect is Midwest-to-Southeast capacity flow, which will tighten Southeast capacity through Wednesday before normalizing Thursday-Friday.

- Recovery Timeline: Lake-effect snow in Indiana/Illinois will clear by Wednesday afternoon, with roads reopening to normal conditions by Thursday morning. Carriers will resume normal speeds and following distances by Thursday, reducing delays from 2-4 hours to normal 30-60 minute variations. Wyoming winds will peak Thursday with gusts 20-25 mph, then ease Friday. I-80 Wyoming routes will normalize Friday-Saturday. Southeast freeze threat will resolve by Thursday as temperatures warm to 63°F+, eliminating agricultural evacuation urgency. Overall market recovery timeline: Wednesday afternoon (Midwest), Thursday (Wyoming), Friday (Southeast). By Friday evening, all weather-related disruptions should be resolved, and capacity should normalize across regions by Monday, November 17.

💰 Financial Market Indicators

- Diesel Futures: Fuel futures indicate steady pricing with minimal volatility, allowing carriers to maintain operational budgets, but brokers should factor in potential upticks from winter demand and weather-related inefficiencies.

- Carrier Financial Health: Carrier financials show resilience through cost controls, though ongoing consolidation in smaller fleets highlights opportunities for brokers to build relationships with stable operators amid capacity shifts.

- Economic Indicators: Modest GDP growth and easing inflation support freight demand recovery, particularly in consumer sectors, positioning brokers to leverage inventory drawdowns for increased spot activity.

📰 Impactful News Analysis

-

Targeted Logistics Investments Cut Healthcare Supply Chain Costs 🔗:

Brokers can highlight enhanced reliability in healthcare lanes to customers, using this trend to negotiate higher margins on temperature-controlled shipments while sourcing carriers with advanced tracking tech to reduce disruption risks and improve on-time performance.

-

Maersk's Strong Q3 Results Signal Ocean Freight Stability 🔗:

With stable ocean rates supporting import volumes, brokers should anticipate inbound surges on coastal lanes, advising customers on multimodal strategies to capitalize on terminal efficiencies and secure capacity before holiday peaks strain trucking extensions.

-

Tighter Shippers' Inventories Poised to Increase Trucking Demand 🔗:

Shifting to just-in-time strategies creates urgency for responsive trucking, enabling brokers to push premium rates on short-lead loads and focus sourcing in high-inventory regions, while preparing customers for potential replenishment spikes that boost load volumes.

News Impact Timeline

- Immediate Operational Reality: Healthcare supply chain investments (ALERT_1) are creating immediate demand for temperature-controlled logistics and advanced tracking. Brokers should expect increased healthcare customer inquiries for reliable reefer and van capacity with tracking capabilities. Maersk's strong Q3 results (ALERT_3) are signaling stable ocean rates, which means inbound surges on coastal lanes are likely within 7-10 days. Brokers should prepare for multimodal customer conversations about truck-to-port connections. Tighter shipper inventories (API_1) are creating immediate urgency for just-in-time trucking, which is already visible in today's 70,420 load volume (up from 64,986 yesterday).

- 3-Day Market Implications: By Wednesday, healthcare customers will likely increase booking activity as they respond to supply chain investment trends. Coastal brokers should see increased inquiries about truck capacity for inbound container drayage. Just-in-time demand will continue accelerating through Wednesday-Thursday as retailers finalize holiday inventory. Brokers should expect 10-15% volume increases in healthcare and retail lanes through mid-week.

- Week-Ahead Positioning: By next Monday (November 17), healthcare supply chain investments should translate into sustained demand for reliable capacity with advanced tracking. Brokers should develop healthcare-specific service packages emphasizing reliability and visibility. Maersk's strong results will likely drive increased port activity by late next week, creating opportunities for truck-to-port positioning. Just-in-time demand will normalize by next week as holiday inventory builds complete, but will resurge the week of November 24 for Thanksgiving. Brokers should position capacity for sustained healthcare demand and prepare for port-related opportunities.

- Regulatory Compliance Impacts: No immediate regulatory changes are indicated in the news analysis. However, healthcare supply chain investments may drive increased compliance requirements around temperature monitoring and documentation. Brokers should ensure carriers have advanced tracking capabilities and proper cold chain documentation. No other regulatory impacts are anticipated for the next 7 days.

🔍 Competitive Intelligence

- Digital Load Board Trends: Spot rate transparency is improving with rising load postings, allowing brokers to benchmark quickly and identify undervalued lanes for arbitrage, though selective carrier bidding underscores the need for strong relationships to lock in favorable terms.

- Capacity Alerts: Tight capacity persists in Midwest weather zones and Southeast ag areas, contrasting with surpluses in the Southwest, where brokers can reposition equipment for premium cross-regional moves.

- Technology Disruptions: Adoption of AI-driven route optimization is accelerating, helping brokers mitigate weather delays and enhance load matching efficiency, while blockchain tracking gains traction to streamline documentation in disrupted supply chains.

Demand Shift Indicators

- Regional Demand Predictions: Midwest demand will intensify through Wednesday as Monday's volume rebound (70,420 loads vs 64,986 yesterday) continues driven by retail holiday inventory pulls and manufacturing restarts. Chicago-Indianapolis and Milwaukee-Detroit lanes will see 8-12% volume increases through mid-week as carriers position equipment and shippers accelerate pre-holiday shipments. By Thursday-Friday, demand will moderate slightly as weather clears and carriers catch up on backlog, but Thanksgiving week (starting November 24) will see renewed demand surge. Southeast agricultural demand will spike Tuesday-Wednesday as freeze warnings drive evacuation urgency, then normalize by Friday as temperatures warm to 63°F+.

- Seasonal Transition Analysis: Current patterns align with typical November pre-holiday acceleration but are amplified by weather disruptions. Normally, November sees 3-5% volume increases week-over-week; we're tracking 8% increases driven by both seasonal factors and weather-induced urgency. This is NOT a permanent demand shift—it's a compression of normal holiday demand into a shorter window due to weather. By late November, demand will normalize as holiday inventory builds complete. The key difference from last year: weather is creating more volatility, which means rate swings will be sharper and more localized.

- Economic Leading Indicators: Modest GDP growth and easing inflation (per first-layer analysis) are supporting freight demand recovery in consumer sectors. Retail inventory pulls are accelerating as retailers prepare for holiday season, which typically drives 15-20% volume increases in November-December. Manufacturing output is steady with energy sector resilience, supporting flatbed demand. However, economic uncertainty around holiday consumer spending could dampen demand in December if retail sales disappoint. For the next 7 days, assume demand remains strong; monitor retail sales data for December implications.

- Capacity Flow Predictions: Equipment will reposition from Southwest surpluses toward Midwest and Southeast deficit zones through Wednesday. Van capacity will flow northbound from Texas/Oklahoma toward Chicago/Indianapolis hubs. Reefer equipment will concentrate in Southeast agricultural zones Tuesday-Wednesday for evacuation loads, then reposition toward holiday food preparation lanes by Friday. Flatbed capacity will avoid I-80 Wyoming routes through Wednesday, creating temporary surpluses in Southwest and deficits in Midwest/Southeast. By Thursday-Friday, as weather clears, equipment will normalize across regions. Expect 15-20% equipment repositioning costs (empty miles) through mid-week.

👥 Customer Sector Analysis

- Retail: Retailers are accelerating holiday inventory pulls, driving van demand on urban routes despite weather hurdles, with brokers advised to emphasize reliable carriers for just-in-time deliveries to avoid stockouts.

- Manufacturing: Industrial output steadies with energy sector resilience, supporting flatbed flows, but freeze risks in the South may delay parts shipments, creating windows for brokers to offer expedited services at premiums.

- Agriculture: Fall harvest wraps amid freezes threatening Southeast and Texas crops, tightening reefer capacity for urgent evacuations, where brokers can target premium perishables lanes to offset seasonal volume dips.

- Automotive: Production ramps for year-end models boost I-65 and I-75 hauls, with capacity strains from weather offering brokers leverage to secure higher rates on just-in-time auto parts movements.

🗺️ Regional & Lane Analysis

📍 Primary Region Focus: Midwest

Midwest markets exhibit rate firmness and capacity tightness driven by lake-effect snow disruptions on key interstates, compounded by industrial demand recovery and seasonal manufacturing cycles, creating premium opportunities for brokers navigating reroutes and urgent hauls.

🛣️ Key Lane Watch

Chicago, IL → Indianapolis, IN:

This lane faces heightened snow accumulations east of I-57, slowing van and reefer flows for consumer goods and perishables with volumes up but carriers cautious on slick conditions. Demand from retail restocking persists amid Monday rebound, while capacity tightens from regional driver hesitancy. Seasonal factors include early holiday builds clashing with weather, elevating urgency for time-definite shipments.

Milwaukee, WI → Detroit, MI:

Heavy snow in Lake and Porter counties hampers I-94 access for automotive and general freight, with flatbed and van loads increasing from manufacturing restarts but weather reducing effective capacity. Demand drivers include parts shipments for auto production, intersected by seasonal cold snaps limiting trailer positioning. Freezes add risks to outdoor facilities, prompting faster turnarounds.

🚨 Actionable Alerts

Rate Spike Warnings:

- Midwest I-80/I-90 lanes for van and reefer due to snow delays

- Southeast I-95 ag routes amid freezes

Capacity Shortage Alerts:

- Most acute in Midwest for all equipment from weather pullbacks, with reefers hit hardest in Southeast freezes affecting produce hauls.

Opportunity Zones:

- Southwest surpluses for repositioning to Midwest premiums

- Northeast urban vans for holiday backhauls

🎯 Strategic Recommendations for Today

💼 For Customer Sales:

Narrative: Emphasize weather-resilient options and just-in-time efficiencies to build trust, noting inventory shifts as rationale for proactive booking.

Action: Initiate calls on Midwest-exposed customers today to upsell expedites and secure commitments before rates firm further.

🚛 For Carrier Reps:

Sourcing Focus: Prioritize Midwest-equipped carriers for snow lanes and Southeast reefers for freeze urgencies, targeting regional specialists.

Negotiation Leverage: Use rising spot volumes and weather premiums to push for volume commitments, highlighting stable diesel for cost predictability.

📞 Customer Communication Scripts

Rate Increase Justification For Midwest Weather-Impacted Lanes

Opening Script: "Good morning [Customer Name]. I'm calling because we're seeing significant activity in your freight lanes today. Spot volumes jumped to 70,420 loads this morning—up from 64,986 yesterday—and we're tracking lake-effect snow across Illinois and Indiana that's already tightening capacity on I-80 and I-90. For your Chicago-to-Indianapolis shipments specifically, we're seeing van rates firm to $1.90 paid versus $1.88 last week. I wanted to reach out before rates move further."

Value Proposition: By booking your loads with us today, you lock in current rates before the mid-week peak we're forecasting. Our carrier network has winter-equipped drivers ready for these conditions, which means reliable delivery windows when competitors are experiencing delays.

Urgency Creator: Weather forecasts show light snow continuing through Tuesday in Indiana with wind gusts up to 28 mph. Carriers are already becoming selective. If you have time-sensitive holiday inventory, the next 24 hours is optimal for booking before capacity tightens further.

Objection Handler: I understand rates are up from last month. Here's the reality: diesel is stable at $3.739, so this isn't fuel-driven. It's pure capacity constraint from weather. Last November we saw similar patterns—rates typically hold firm through mid-month, then ease after Thanksgiving. Locking in now protects your budget from further escalation.

Capacity Shortage Communication For Reefer Loads

Opening Script: "Hi [Customer Name], I'm reaching out because we're tracking a developing opportunity in cold chain logistics. Reefer rates are at $2.37 paid per mile today—up from $2.34 last week—and volumes are climbing as freeze warnings hit the Southeast and Texas. We're seeing capacity constraints in California and Midwest reefer pools, which typically means premium pricing for the next 7-10 days."

Value Proposition: If you have perishable shipments planned for this week, we can guarantee carrier availability with our established reefer network. This is especially valuable given the freeze threats in North Carolina, South Carolina, and Georgia—produce evacuations are likely, which means your standard loads could face delays if you wait.

Urgency Creator: South Carolina is currently at 52°F with winds 18-29 mph, and freeze warnings are in effect. Temperatures are expected to remain in the low 50s through Wednesday before warming. Agricultural operations are likely moving inventory today and tomorrow to avoid crop damage. Capacity will tighten significantly by Tuesday afternoon.

Objection Handler: Yes, reefer rates are higher than van alternatives. But here's what matters: your perishables require temperature control regardless. The question is whether you want guaranteed capacity at today's $2.37 rate or risk delays and emergency pricing at $2.60+ if you wait. Plus, our carriers have advanced tracking—you get visibility that reduces your liability exposure.

Flatbed Opportunity Positioning For Manufacturing Customers

Opening Script: "Good morning [Customer Name]. I wanted to flag something important for your manufacturing operations. Flatbed rates are holding steady at $2.11 paid per mile, but volumes jumped 15% from yesterday as automotive and energy sectors ramp up. We're tracking high winds in Wyoming affecting I-80 transcontinental routes, which is actually creating a capacity advantage for regional flatbed moves."

Value Proposition: Your I-65 and I-75 auto parts shipments are in a sweet spot right now. While transcontinental flatbed capacity is being diverted around Wyoming wind issues, regional Midwest-to-Southeast routes have strong carrier availability. We can guarantee equipment for your just-in-time production schedules without the premium pricing you'd see on cross-country hauls.

Urgency Creator: Wyoming is forecasted to have partly sunny conditions through Wednesday with winds 11-15 mph—manageable for most loads. But carriers are already repositioning equipment away from I-80 summit routes. By Thursday, when winds are expected to increase to 20-25 mph, flatbed capacity on transcontinental routes will be significantly constrained. This creates a 48-hour window for us to position your equipment efficiently.

Objection Handler: I know you're used to stable flatbed pricing. The reality is we're seeing selective capacity tightness in specialized equipment. Your advantage is that your regional routes aren't affected by Wyoming weather, so we can offer you stable rates while transcontinental shippers pay premiums. Lock in your weekly volume with us, and we'll guarantee consistent pricing through the holiday season.

🔑 Executive Signal Summary

- Anchor linehaul to soft national averages; sell audited weather risk: National average holds at $2.19/mi with OTRI (Outbound Tender Rejection Index) low, so keep base rates disciplined and itemize detours, freeze-protect (FP), and wind stop-work where risk is real.

- Exploit mode spreads now: Vans paid > posted (+$0.01) = mild firmness on retail lanes; Reefers paid > posted (+$0.02) = tightening into SE freezes; Flatbeds paid < posted (−$0.02) = near parity and best buy leverage outside OH/TX energy pockets.

- Mon–Wed compression window: Weather delays + backlog will push mid-week premiums on Great Lakes bypass lanes and SE reefers Tue–Wed; pre-book today to lock capacity before the cascade peaks.

- Route around I-80/90 and WY winds: Shift to I-65/I-70/I-75 to bypass lake-effect impacts; divert transcon from I-80 WY to I-40/I-44 and add wind clauses. Expect normalization: Midwest Wed PM, WY Fri, SE Thu.

- Separate FSC (Fuel Surcharge), protect margin: Diesel steady at $3.739/gal; keep FSC separate and pass weather costs as line items, not baked into linehaul.

- Pre-stage sector wins: Healthcare cold chain (tracking + compliance) and port-connected dray/transload conversations for late next week on ocean stability signals.

📊 Market Moves You Can Trade Today

- National snapshot

- Total loads: 70,420 | Market opportunity: $91.2M | Avg rate: $2.19/mi | Diesel: $3.739/gal

- Mode spreads (paid vs posted)

- Van: $1.90 paid vs $1.89 posted → + $0.01 (retail/metro lanes showing quiet firmness)

- Reefer: $2.37 paid vs $2.35 posted → + $0.02 (freeze + holiday foods tightening capacity)

- Flatbed: $2.11 paid vs $2.13 posted → − $0.02 (near parity; buy leverage except OH/TX energy)

- Heavy haul: $2.12 paid vs $2.30 posted → − $0.18 (strong buy leverage if you can guarantee dwell/permits)

- Capacity state

- OTRI low: Ample capacity nationally; tight micro-pockets in Great Lakes, SE ag zones, and transcon flatbed avoiding WY winds.

- Behavioral edge

- Carriers trade CPM for certainty: Bundle out-and-back, guarantee daylight appts, low dwell, fast PODs → 10–20 cpm savings.

🌦 Weather-to-Operations Playbook (Next 72 Hours)

- Great Lakes lake-effect (IL/IN; I-80/I-90)

- Impact: 2–4 hr delays today; slick roads, visibility issues. Clearing Wed PM.

- Tactics: Route via I-65/I-70/I-75, extend PU/DEL buffers, pre-approved alternates on rate confirmations (RCs).

- Pricing: +5–10% bypass premium, $100–$225 detour, $75–$125 weather standby.

- WY high winds (I-80 summit; I-25 Cheyenne/Laramie)

- Impact: Hazard to high-profile units; selective closures. Winds peak Thu (20–25 mph gusts); easing Fri.

- Tactics: Shift long-hauls to I-40/I-44, add wind stop-work clause, daylight-only passes, safe-harbor staging.

- Pricing: $75–$150 wind stop-work, time-based detention after 2 hrs.

- SE/SC/GA freezes; North/Central TX cold

- Impact: Tue–Wed reefer surge for ag evacuations; TX warming reduces immediate risk.

- Tactics: Reefer continuous mode, no overnight yard dwell, pulp checks + seal photos, consider van FP for non-perishables.

- Pricing: $75–$150 freeze-protect surcharge; enforce dock-door time caps for open-door exposure.

🧭 Capacity Positioning: Where to Buy, Where to Sell

- Buy zones (faster cover, better margins)

- Southwest (AZ/NM/West TX): Surplus from WY avoidance; target van/flatbed long-hauls into Midwest/Southeast deficits.

- West Coast + NE metros: Van/reefer surplus for repositioning; bundle returns to hold buy costs.

- Non-freeze Midwest reefers: Pull into SE Tue–Wed; secure round-trips back to holiday food lanes Fri.

- Sell zones (premium opportunities)

- Great Lakes bypass lanes: Chicago/NW IN → IND/CVG/Louisville on I-65/I-74/I-75 with itemized detours.

- SE reefer: Carolinas/GA evac and holiday foods Tue–Wed; guarantee capacity with SOP to command premiums.

- Energy/manufacturing flatbed: OH/TX projects; charge securement + wind clauses; avoid WY corridors mid-week.

🛣 Priority Lanes & Price Bands (Linehaul; add FSC + accessorials)

- Chicago, IL → Indianapolis, IN (Van ~185 mi; I-65 bypass)

- Buy $1.80–$2.10 | Sell $2.35–$2.90 | Detour $100–$150

- Milwaukee, WI → Detroit, MI (Van ~380 mi; auto parts)

- Buy $1.85–$2.20 | Sell $2.45–$3.00 | Weather standby $75–$125

- Chicago, IL → Louisville, KY (Van ~300 mi; holiday retail)

- Buy $1.85–$2.15 | Sell $2.40–$2.95 | Detour $100–$175

- Charlotte, NC → Jacksonville, FL (Reefer/Van FP ~380 mi)

- Reefer Buy $2.90–$3.35 | Sell $3.50–$4.10 | FP $75–$125

- Van FP Buy $2.10–$2.45 | Sell $2.70–$3.20

- Savannah, GA → Atlanta, GA (Reefer/Dray-fed ~250 mi)

- Reefer Buy $3.00–$3.45 | Sell $3.60–$4.20 | Peak Tue–Wed

- Kansas City, MO → Dallas, TX (Flatbed ~500 mi; wind watch)

- Buy $2.25–$2.60 | Sell $2.85–$3.35 | Wind stop-work $75–$150

- DFW, TX → Baton Rouge, LA (Flatbed ~400 mi; energy)

- Buy $2.10–$2.45 | Sell $2.70–$3.20 | Securement itemized

- Pro tip: Hold linehaul steady; itemize detour/wind/FP so shippers see you controlling base costs and charging for documented risk only.

🧪 Sector Plays (24–72h)

- Retail (van): Push just-in-time (JIT) replenishment on urban lanes; pre-commit Wed–Fri windows to avoid mid-week surge exposure and protect OTIF.

- Healthcare (reefer/van): Lead with reliability and tracking; pitch a healthcare SOP (temp logs, chain-of-custody, GPS visibility) and lock 1–2 weekly trucks now for stability.

- Automotive (van/flatbed): I-65/I-75 corridors are tight with weather + JIT parts; sell reliability premiums; offer expedites with double coverage for choke points.

- Manufacturing/Energy (flatbed): Sell regional (Midwest→SE) while transcon avoids WY; bill tarp/edge protection and wind clauses.

🗣 Sales Scripts You Can Use Today

- Midwest weather justification (Van)

- “We’re holding your base linehaul near today’s soft averages and adding a documented I-65 bypass detour while lake-effect slows I-80/90. Locking trucks now avoids the Wed backlog premium.”

- Reefer SE surge (Perishables)

- “Freeze warnings are already pulling reefers into the Carolinas/GA. Today we can guarantee continuous-mode capacity at current $2.37/mi averages. By tomorrow afternoon, evacuations will tighten capacity and push rates.”

- Flatbed capacity advantage (Regional)

- “Transcon flatbeds are diverting from WY winds, which opens up regional availability for your I-65/I-75 moves. We’ll lock equipment and guarantee securement without cross-country premiums.”

🤝 Carrier Desk: Sourcing, SOPs, Negotiation

- Compliance must-haves

- FMCSA safety OK; MCS-150 current; BMC-84 and insurance verified; Drug & Alcohol Clearinghouse checked.

- Reefer SOP: Pre-cool, continuous mode, ¾+ fuel, pulp + photo log, seal # on BOL/POD, temp records attached.

- Negotiation levers

- Bundle out-and-back (48–72h) to shave 10–20 cpm; commit daylight appts + fast unloads.

- FSC discipline at $3.739/gal; linehaul steady; pay only documented detours/standby.

- Guardrails

- GM floors: Van ≥16%, Reefer ≥20%, Flatbed ≥18%, Heavy ≥14%.

- Detention: 2 hrs free then enforced; Layover: $300–$500/day; Wind stop-work: $75–$150; FP: $75–$150.

- No overnight yard dwell for FP/perishables.

🧨 Risk Map & Mitigations

- Lake-effect persists into Wed AM

- Mitigation: Pre-approved alternates on RC; set 2–4 hr buffers; swap-ready backup in IND/CVG.

- Reefer claims (freeze)

- Mitigation: Live load/unload only; continuous-mode verification on arrival/departure; reject open-door dwell >20 min without temp control.

- WY wind closures stack

- Mitigation: Southern alternates; pre-stage safe harbors; driver stop authority in RC; re-rate if closure >4 hrs.

- Port surge spillover (late next week)

- Mitigation: Reserve chassis/transload slots 5–7 days out; standardize port fees and free time.

📅 24–72 Hour Runbook

- Morning (now–noon)

- Lock 10–15 Great Lakes bypass vans (CHI/MLW → IND/CVG/Louisville) with detour lines.

- Secure 6–10 SE reefers (NC/SC/GA evac + holiday foods) with strict SOP; no yard dwell.

- Stage 5–8 flatbeds KC/DFW/TUL with wind clauses; pre-plan I-40/I-44 alternates.

- Midday (noon–3p)

- Bundle Wed–Fri returns for all weather lanes; target ≥70% reload pairing to reduce empty miles.

- Push healthcare package to top 5 accounts: telematics, temp logging, chain-of-custody.

- Afternoon (3p–EOD)

- Send rate-hold memos: linehaul tied to $2.19/mi averages; itemized weather/FSC examples.

- Pre-book Fri northbound reloads from SE/Midwest to capture normalization snapback.

- KPIs to hit

- Time-to-cover ≤45 min (surge lanes)

- Reload pairing ≥70%

- Accessorial capture ≥80% where eligible

- Claim-free reefer ≥99.5% with full proof packs

🔭 What to Watch Next

- Paid–posted spreads: If vans widen >$0.03, push metro backhaul sells; if reefers widen >$0.05 Tue PM, hold rate on late adds.

- I-80/90 reopening pace: Reduce detour line items as buffers shrink Wed PM.

- SE temp rebound Thu: Convert emergency reefer holds back to planned food lanes; reposition to Midwest/Northeast for weekend.

🧠 Broker Psychology Edge

- Price the proof, not the fear: Customers accept premiums they can audit—detours, FP, wind standby—while you keep base freight tied to national softness.

- Guarantee beats gamble: Offer certainty (tracking, SOPs, reloads) to buy down carrier rates and sell up shipper value.

- Pre-commit into the surge: Today’s commitments turn tomorrow’s capacity crunch into your margin.

📅 This Day in History

1702: English colonists under the command of James Moore besiege Spanish St. Augustine during Queen Anne's War.

1954: U.S. President Dwight D. Eisenhower dedicates the USMC War Memorial (Iwo Jima memorial) in Arlington Ridge Park in Arlington County, Virginia.

1967: The Nauru Independence Act 1967 passed the Parliament of Australia, giving independence to the UN Trust Territory of Nauru with effect from 31 January 1968.

😄 Joke of the Day

What did the cell say when his sister cell stepped on his foot? Mitosis.